The e-Invoice mandate as per the GST Notification 10/23 had been extended to the businesses with a turnover exceeding Rs. 5 crores from 1st August 2023. GST continues the process of enabling e-Invoicing for the businesses and gradually narrowing the turnover limits to maximize the number of business houses for making e-Invoices. Let's proceed with the topic 'E Invoice Exemption Declaration functionality for the taxpayers eligible for exemption but enabled for e-Invoicing'.

Key points of e-Invoice Exemption Declaration functionality:

- The e-Invoice Exemption Declaration is optional for enlisted RTPs.

- This functionality is for taxpayers who are exempt from e-invoicing as per the CGST Rules.

- Submitting declaration through this functionality will not change the taxpayer’s e-Invoice status.

- Taxpayers are responsible to decide on exemption and reporting through this functionality.

- This functionality is provided to make business process easier.

The e-Invoice Portal:

The link for e-Invoice portal is: https://einvoice.gst.gov.in/einvoice/dashboardThe Invoice Registration Portals (IRPs):

However, to facilitate the generation, cancellation, and reporting of e-Invoices under the Goods and Services Tax (GST) regime, there are six government-authorized IRPs (Invoice Registration Portals) – as section of the e-Invoice portal.

Non-compliance with e-invoicing:

As the consequences of non-compliance with e-invoicing could lead to heavy penalties. GST continues to enabling the e-Invoicing for organization as per their turnover irrespective of exemption criteria.

The taxpayers who are by default enabled for e-invoicing but are under exempted category and they still not reporting their invoices to generate IRN (Invoice Registration Number) through any IRPs (Invoice Registration Portals) provided under the main e-Invoice Portal are automatically being listed as non-complying RTPs.

All such Registered Tax Payers (RTPs) willing to go with exemption are required to submit e-Invoice Exemption Declaration as follows:-

Step-1. First of all, check for your exemption criteria mentioned here under:

- Special Economic Zone Units (61/2020 – Central Tax dated 30th July 2020)

- Insurer (13/2020 – Central Tax dated 21st March 2020)

- Banking company (13/2020 – Central Tax dated 21st March 2020)

- Financial Institution (13/2020 – Central Tax dated 21st March 2020)

- Non-banking financial company (13/2020 – Central Tax dated 21st March 2020)

- Goods transport agency supplying services in relation to transportation of goods by road in a goods carriage (13/2020 – Central Tax dated 21st March 2020)

- Suppliers of passenger transportation service (13/2020 – Central Tax dated 21st March 2020)

- Suppliers of services by way of admission to exhibition of cinematograph films in multiplex screens (13/2020 – Central Tax dated 21st March 2020)

- Government Department (23/2001 – Central Tax dated 01st June 2021)

Step-2. Check your e-Invoice enablement status on the portal:

Open GST common portal : www.gst.gov.inClick on e-Invoice option as above screen

Or open the link: https://einvoice.gst.gov.in/einvoice/dashboard

Step-3. Click on Check Enablement Status will show the next pop-up screen as under:

FINALLY, IF YOU HAVE THE ELIGIBLE CRITERIA FOR EXEMPTION BUT ENABLED FOR E-INVOICE THEN YOU HAVE TO OPT EITHER TO COMPLY WITH GENERATING E-INVOICES OR TO SUBMIT YOUR E-INVOICE EXEMPTION DECLARATION.

Step-4. Click on the box 'e-Invoice Exemption Declaration' provided under e-Invoice portal.

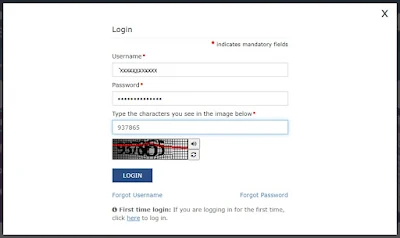

System will pop-up for login screen as under

Step-5. Log in using your GST portal credentials:

After successful login a message will appear

Step-6. Submit the e-Invoice Exemption Declaration:

>Select your eligible and relevant category from the drop-down list provided,

>Click the check box for your declaration/consent, and

>Select the Authorized Signatory then

>Click on SUBMIT button will complete the process.

Step-7. Download Declaration:

After successful submission, you can download the e-Invoice Exemption Declaration for your records and future reference.

By following these steps, you can efficiently file your e-Invoicing Exemption Declaration on the GST e-Invoice portal.

Hope this will be a helpful article.

Thanks and Regards,

Team Tech-Guide-Tax

REF-A1019-24-GUIDE-019-EINV-003-AP

Disclaimer: This article and its contents and the relevant screen shots presented are prepared from the respective official portal/website in the interest of public /readers /subscribers only for reference and general information purpose, easy understanding, to provide more clarity and technical help in view to complete the online process efficiently. However, the subscribers/Readers/Users are suggested to go through the User Manual / Guide / Notifications provided in the respective portals/Websites before acting upon the required service. Our Privacy Policy and Terms and Conditions shall be applied.