Presenting this article to understand the process of in-built mechanism of auto grant of refund on account of export with payment of tax for the period of GSTR-1 and GSTR-3B properly filed in GST portal by the exporter. Let's proceed to know about the refund on account of export with payment of tax under GST.

Introduction:

Under GST law, export of goods and services are zero rated supply as per provision of section 16 of IGST Act, 2017. There are two options available under GST to claim refund on account of export:

i) Exports of goods or services or both under bond or letter of undertaking (LUT) Without Payment of Tax and claiming refund of unutilized Input Tax Credit (ITC); and

ii) Exports of goods or services or both With Payment of Tax (by utilizing ITC) and claiming refund of the tax paid on export.

Here we consider ii) option as the topic for discussion, hence let's proceed with topic - 'Refund on Account of Export of goods or services or both (with payment of Tax)'.

For getting refund under this category, no separate refund application is required to file since Shipping Bill itself shall be treated as refund application. GST portal has an automated ICEGATE transmission process of all the export details with payment of tax on certain conditions as follows: -

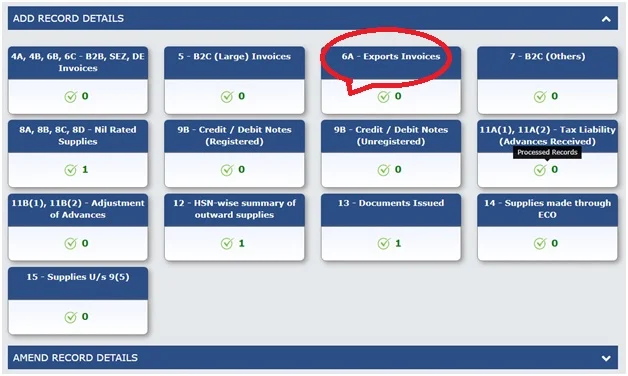

1.Proper filing of statement in GSTR-1: The Export Invoices details (Correct and complete Shipping Bill Number, Shipping Bill Date and Port Code) along with Shipping bill details having IGST and/or CESS levied in Table 6A of GSTR-1; and

2.Proper filing of return in GSTR-3B: IGST and/or CESS amount is reported in Table 3.1(b) of Form GSTR-3B (and not table 3.1(a) or 3.1(c)) must be either equal to or greater than, the total IGST and CESS amount shown to have been paid under table 6A and table 6B of Form GSTR-1 of corresponding return period.

3.Once GSTR-1 and GSTR-3B filed then GST Portal shares the Export data declared under Form GSTR-1 along with a validation that Form GSTR-3B has been filed for the relevant tax period with ICEGATE. Customs System validates the Form GSTR-1 data with their Shipping Bill and EGM data and process the refund.

4.While the refund payment will be credited to the account of the taxpayers, the ICEGATE system shares the payment information with the GST Portal and the GST Portal shares the information through SMS and e-mail with the taxpayers. And finally, the refund will be credited in the Bank account mentioned with the ICEGATE/ Customs.

Export Ledger on the GST Portal:

GST system has Ledger based approach to cumulate the IGST/CESS from Export/SEZ invoices (Table 6A/9A/6B of GSTR-1), and compare with IGST/CESS paid under Table 3.1(b) of GSTR 3B across all periods.

How To access Export Ledger on the GST Portal?

After Login into the GST portal, navigate to Services -> Refunds -> Track status of invoice data to be shared with ICEGATE -> select the View Export Ledger link.

Tracking the status of refund for IGST and/or CESS paid on account of Export of Goods or Services or both:

After Login to the GST Portal, navigate to Services -> Refunds -> Track status of Invoices data to be shared with ICEGATE service from the GST Portal.

Different types of status and issues in GST refund on account of export with payment of tax:

The refund amount may get delayed in case of mismatch of shipping bill with the GST Returns and many other reasons as follows: -

1.Details not transmitted to ICEGATE - GSTR-1 not filed:

Details not transmitted to ICEGATE – GSTR-1 not filed:

File GSTR-1 of the stated return period

2.Details not transmitted to ICEGATE - IGST paid under Table 3.1(b) of Form GSTR 3B is less than refund claimed:

The invoices have not been transmitted to ICEGATE as cumulative total of IGST amount in Table

3.1(b) of all Form GSTR-3Bs filed so far is less than cumulative total of IGST amount in Table 6A and 9A of all Form GSTR-1s filed so far. The deficient amount is Rs.<amt>.Additionally, cumulative total of CESS amount in Table 3.1(b) of all Form GSTR-3Bs filed so far is less than cumulative total of CESS amount in Table 6A and 9A of all Form GSTR-1s filed so far. The deficient amount is Rs.<amt>.

Take care of this deficiency in next return Form (GSTR-1 and GSTR-3B) ensuring that there is no deficiency at aggregate level. The invoices shall be re-validated in next cycle and sent to ICEGATE if this deficiency is cleared in next Form GSTR-3B.

3.Return data is yet to be Processed:

Data for the given return period is yet to be processed by the GST System. The data shall be processed and sent to ICEGATE shortly.

4.Details to be transmitted/partially transmitted to ICEGATE as below:

You can amend these errors in Table 9A of subsequent month Form GSTR-1 by making appropriate corrections and the record shall be revalidated in next execution cycle.

5.Aadhar Authentication is mandatory for ICEGATE transmission process:

Invoices cannot be sent to ICEGATE without Aadhaar Authentication or uploading e-KYC documents.

6.GST portal will not transmit any eligible invoice to ICEGATE if:

The eligible invoices are transmitted by GST Portal to ICEGATE only if the IGST/CESS paid under Table 3.1(b) >= IGST/CESS from invoices of Tables 6A/6B/9A.

Conclusion:

Indeed, there is nothing to do except filing returns accurately. The refund on Account of Export of goods/services (with payment of Tax) is an automated process involving three different systems of GST, ICEGATE and PFMS. In case of refund not received then taxpayer need to go through his filed returns and check thoroughly the details entered there. On occurrence of any mistakes, taxpayer need to amend the required information before filing his next due return within the running financial year or under admissible period.

Thanks and Regards

Team Tech Guide Tax

REF-A1018-24-GUIDE-018-EXPRT-001-AP

Disclaimer: This article and its contents and the relevant screen shots presented are prepared from the respective official portal/website in the interest of public /readers /subscribers only for reference and general information purpose, easy understanding, to provide more clarity and technical help in view to complete the online process efficiently. However, the subscribers/Readers/Users are suggested to go through the User Manual / Guide / Notifications provided in the respective portals/Websites before acting upon the required service. Our Privacy Policy and Terms and Conditions shall be applied.