GST has enabled the e-Way Bill Generation through Mobile App functionality to download the Mobile App and Generate e-Way Bill. The complete step by step installation process about e-Way Bill Generation through Mobile App and detail description about the e Way Bill mobile app.

A STEP BY STEP GUIDELINES ARE HERE UNDER:

REGISTRATION AND CREATION OF USERNAME AND PASSWORD FOR THE FIRST TIME:-

• Open E-Waybill portal https://ewaybillgst.gov.in/

• Enter your GSTIN and click Go -> some

fields like Applicant name, Trade name, Address, and mobile number are

auto populated.

• Select the Send OTP option and Verify the OTP you receive on your registered mobile

number.

• The final step is to create a Username and Password to

access the system. The system verifies the Username and sends either an

approval or rejection message. If your username was rejected, a new name

must be provided until the system approves.

• Once a request for registration is submitted, the

system validates the entered values and pops up the appropriate message if

there is any error. Otherwise, the username with password is created and

registered with e-Way Bill System. The taxpayer can use this registered

username and password to work on the system.

After

Registration, the user can Login in to the E-Waybill Portal with the User Id

& Password.

E-Waybill

Login : Click Login-> option right-top of the E-Waybill portal

After successful Login, Registration process of Mobile for using Mobile App :

Click

on Registration

-> For

Mobile option in the left-side of the home page of E-Waybill portal

System will display the Mail-ID and Mobile Number of main user:

(In

case of single user itself is the main user and In case of multiuser the main

user is one who created sub-users)

• The user needs to select

the concern User from the drop-down

list.

• Name and Place will be auto populated by the system.

• In order to Enable the concern user with android

app, user needs to enter the IMIE Number of

the mobile device and click -> Enable

option.

Once Enabled, the concerned user detail as under along with the option

to send link to the registered mobile for downloading the Android App listed

under – Already Registered Handsets :-

After successful

installation of the App, the following Icon will appear on Mobile –

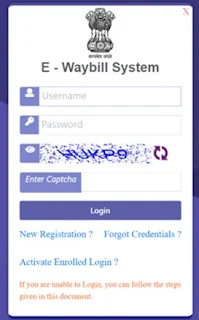

On clicking the above Icon, Login Screen will appear as

And will Show Device ID

Next, the User has to Select the Mobile user and the IMEI No. is to be updated with the Device ID displayed on the Mobile App Login page.

Note : Click on Select option and then enter Device ID in place of IMEI Number and Click on Update option.

After message appeared as Successfully Updated the Mobile App is now ready to Login.

GET READY WITH THE FOLLOWING INFORMATION

TO GENERATE E-WAYBILL:-

For

PART-A

- Supply Type (Outward /

Inward)

- Sub Supply Type (Supply/Export/Import/Job Work/ For Own Use

etc.)

- Document Type (Invoice/Delivery Challan etc.)

- Document Date

- Transaction Type (Regular/ Bill To – Ship To/ Bill From – Ship From

etc.)

- Bill From & Dispatch From

- Bill To & Ship To

- Item Details (Product Name, HSN, Quantity)

- Value of Goods & Tax Rate

- Transporter Id (if goods are being sent through transporter)

- Approximate Distance

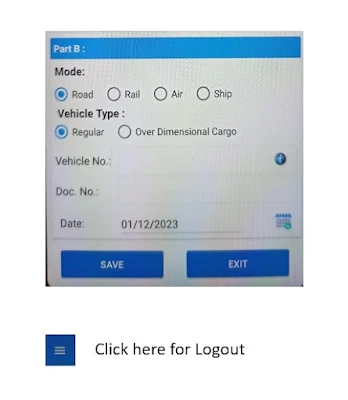

For PART-B

- Mode of Transport (Road/ Rail/ Air/ Ship)

- Vehicle Type (Regular/ Over Dimensional Cargo)

- Vehicle No.

- Transport Document No. & Date

AFTER LOGIN IN MOBILE APP, OPTIONS ARE

AS FOLLOWS:-

Hope, the article will help to generate e-Waybill through Mobile App.

Thanks and Regards,

Team Tech-Guide-Tax

REF-A1006-24-GUIDE-006-EWB-001-AP