While approaching to online option provided on the official portal of the West Bengal Professional Tax, system redirect to another portal as "SILPASATHI". Here is the step by step process described to Apply West Bengal Profession Tax Registration through SILPASATHI portal.

This article covers all the questions like :>How to get WB profession tax registration?

>How to find profession tax registration in West Bengal?

>What is the Profession tax registration process West Bengal?

>How to download profession tax registration certificate West Bengal?

Open the West Bengal Professional Tax portal : https://wbprofessiontax.gov.in/

Click the check box – First Time Application – click Continue

A pop-up message will appear referring the related notification, click Ok button of the message appeared to go SILPASATHI portal

On the landing page of the SILPASATHI portal – click Apply online in the right-top corner of the screen.

A sign up window will open as Sign to Continue -> Create New

A pop-up box for Category will appear, click the relevant category & click the check box for the declaration and click Continue button to proceed for next screen.

Note :

1. Select the appropriate Category. If don’t have MSME (Uddyam Registration) then you may go for Exempted Category and click Continue button.

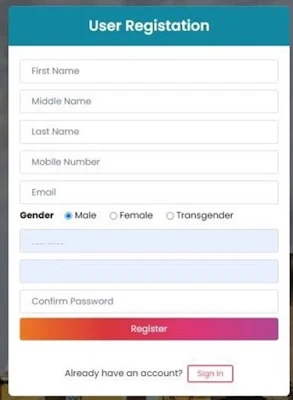

A User Registration window will appear – fill up all the required fields – [First Name, Middle Name, Last Name, Mobile Number, Email, Gender and New User Name & Password] and click Register button to receive a confirmation email.

Next, Login with the same credential providing Enter your Username, Password and Captcha Code.

After Login, DASHBOARD page will open. Click on ALL SERVICES tab to select your required service from the list appeared.

Now click the check box before the – Department Name “Finance” for the Service Name as – Registration under Profession Tax and click Create CAF button in right bottom of the screen.

A Common Application Form (CAF) ID will be created displayed as BUSINESS REFERENCE ID in the left Bottom of the screen and then click on Apply Online button in right bottom side if the screen.

Next to this, Profession Tax ENROLMENT NUMBER to be provided before proceeding further, click – Save & Continue button in bottom right of the screen.

System will auto fetch and display the details based on the given Enrolment Number.

Fill and Review the detail of the application and click on Save & Continue for next screen.

Office Selection - Select District, Sub-Division and Police station, Pin Code, Address of your unit office, Mobile Number, Enrol Dt., PAN No., Registered Under, WBST No., GSTIN, Existing Bank Details etc.

Click the check box for declaration (in bottom left of screen) and then click Save & Continue button in bottom right of the screen.

Finally, system will display all the information to see and verify. Click check box for the declaration in bottom left and click Submit button in bottom right of the screen to complete the application process.

The next course of action will be either the application will Approved or Rejected. Accordingly SMS and email will receive.

Now go to the user DASHBOARD tan and check the status of the COMMON APPLICATION FORM (CAF).

For any correction in the application if required – Go to the DASHBOARD and click Back for Correction.

If the application approved then download the Profession Tax Registration Certificate by clicking – View / Download Registration Certificate button.

Keep downloaded/printed professional tax registration certificate. Deduct the Professional Tax as per scheduled from the Salary/Wages of employees and Pay the due tax generating the challan online through the GRIPS portal monthly and submit the return annually.

Related FAQs:

Q1.What to do if challan paid but status is pending?

As the payments are made through the portal GRIPS, sometime the amount deducted from the bank but the status of the challan reflected as Pending due to some online network/technical server issues. So do not worry, it will take hardly 72 hours to get auto Paid otherwise will refunded to the account.

An email requesting the authority for correction of the period of the paid challan can be forwarded to the official email-ID given in the Professional Tax Portal, West Bengal. The application should clearly contain about the mistake and exactly what it should be along with Enrolment / Registration no, the PAN card detail and the GRN Number of the challan.

Check for the period of the challan paid and the period of the return you want to submit and/or check for the payment account head viz, paid as TAX, Late Fee, Interest etc. The challan paid as Late fee / Interest can not be adjusted or utilize to pay as Professional Tax.

Being a Director of a Company/Firm in West Bengal, irrespective of your present living location, is liable to pay professional. if you already have enrolment no then pay the required tax as per the scheduled otherwise apply for the enrolment number and then pay the liable taxes as per the scheduled after getting the enrolment number.

There should not be any confusion that a Company/Firm existing in West Bengal having its own enrolment number and paying regular professional Tax is not enough for all its directors. Being the directors, each are liable to have individual enrolment number and pay the liable professional tax as per the schedule.

That's all and hope this article will help you to get the W.B. Profession Tax Registration Number.

Thanks and Regards,

Team Tech Guide Tax

REF-A1011-24-GUIDE-011-PTAX-001-AP

Disclaimer: This article and its contents and the relevant screen shots presented here are prepared from the respective official portal/website in the interest of public /reader /subscribers only for reference and general information purpose, easy understanding, in view to provide more clarity and technical help to obtain online West Bengal Professional Tax Registration Number. However, the subscribers/Readers/Users are suggested to go through the User Manual / Guide / Notifications provided in the respective portals/Websites before acting upon the required service. Our Privacy Policy and Terms and Conditions shall be applied.